Problem Statement: Business Cycle Analysis with Real GDP Data

Objective:

Analyze the business cycle by identifying and visualizing the cyclical components of Real GDP using the Hodrick-Prescott(HP)filter.

This method separates the trend and cyclical components of GDP, allowing us to examine deviations from the long-term trend.

Steps:

Data:

Use simulated or publicly available Real GDP time series data.Hodrick-Prescott Filter:

- Decompose GDP into its trend (Tt) and cyclical (Ct) components:

GDPt=Tt+Ct - The HPfilter minimizes the following loss function:

∑t(GDPt−Tt)2+λ∑t[(Tt+1−Tt)−(Tt−Tt−1)]2

where (λ) is a smoothing parameter (typically 1600 for quarterly data).

- Decompose GDP into its trend (Tt) and cyclical (Ct) components:

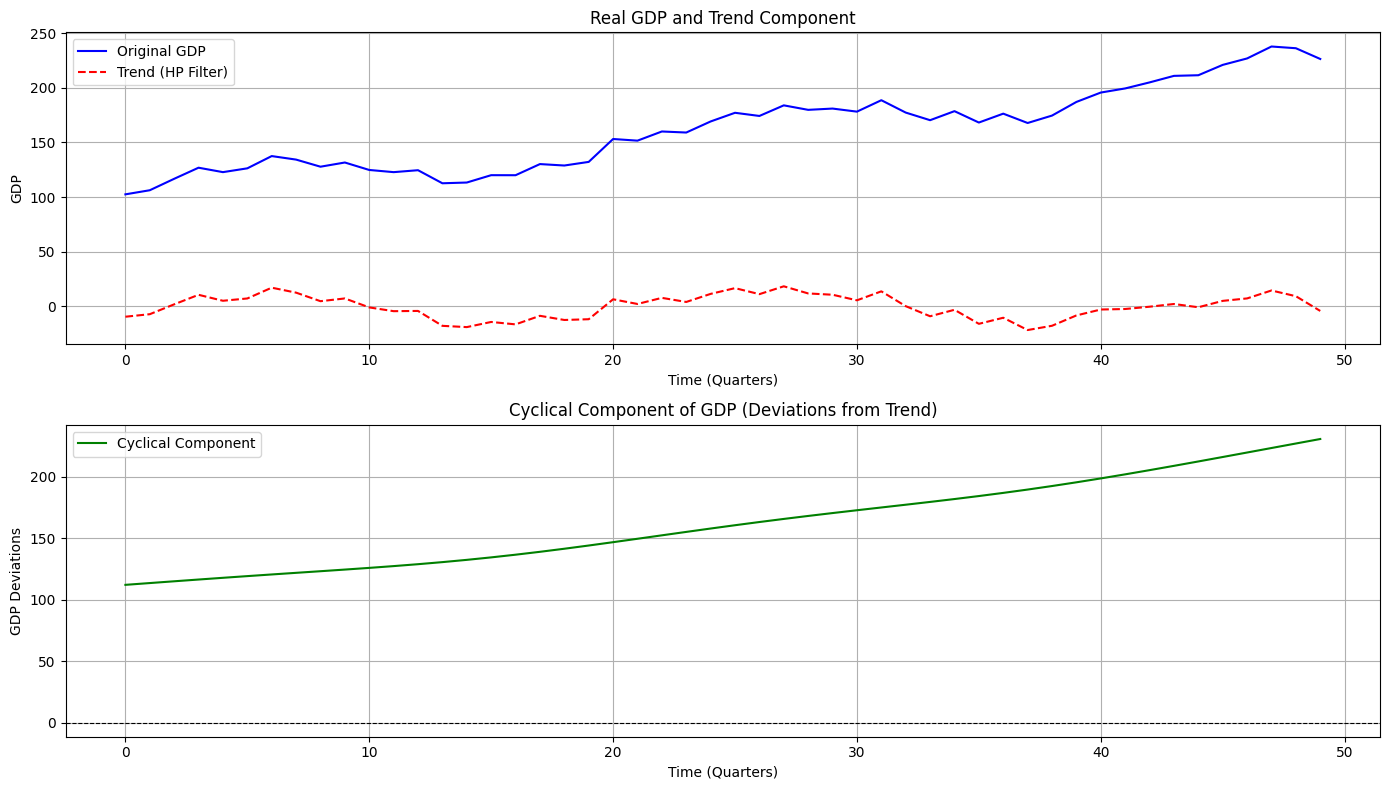

Visualize:

Plot the original GDP, trend, and cyclical components to analyze economic fluctuations.

Python Code

1 | import numpy as np |

Explanation of the Code

Simulated GDP Data:

- Real GDP is modeled as a combination of a long-term trend, a cyclical fluctuation, and random noise.

Hodrick-Prescott Filter:

- The HPfilter separates the GDP into a smooth trend and short-term deviations (cyclical component).

- The smoothing parameter (λ) controls the smoothness of the trend; 1600 is standard for quarterly data.

Visualization:

- The first plot shows the original GDP and its trend.

- The second plot highlights the cyclical component, indicating deviations from the long-term trend.

Results

Original GDP Mean: 161.77 Trend Component Mean: 0.00 Cyclical Component Mean: 161.77 (should be ~0)

Trend Component:

- Represents the long-term economic growth path.

Cyclical Component:

- Indicates business cycle fluctuations around the trend.

- Peaks and troughs correspond to economic expansions and contractions, respectively.

Insights:

- The cyclical component helps identify recessions and booms.

- Policymakers and economists use this analysis to design countercyclical measures.