Problem Statement: Business Cycle Analysis with Real GDP Data

Objective:

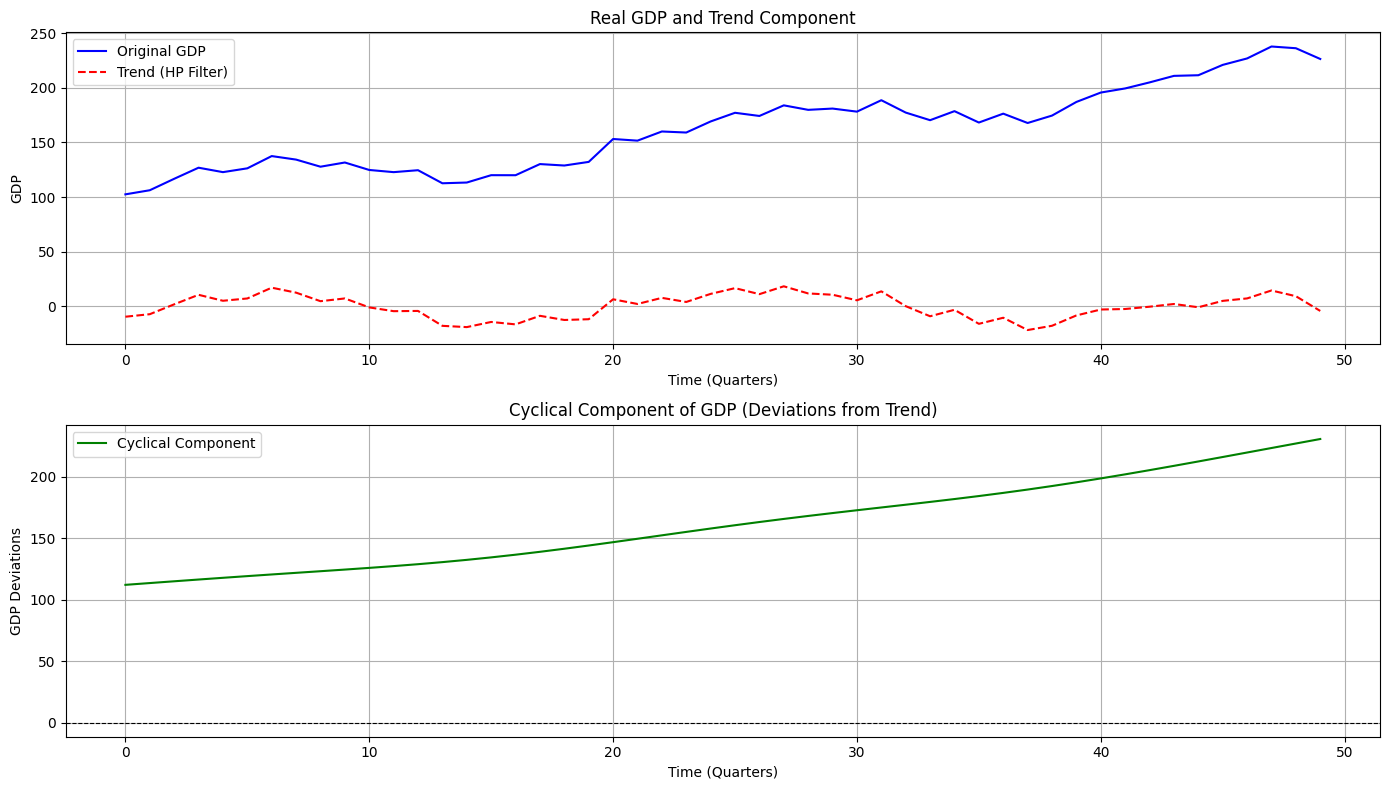

Analyze the business cycle by identifying and visualizing the cyclical components of Real GDP using the $Hodrick$-$Prescott (HP) filter$.

This method separates the trend and cyclical components of GDP, allowing us to examine deviations from the long-term trend.

Steps:

Data:

Use simulated or publicly available Real GDP time series data.Hodrick-Prescott Filter:

- Decompose GDP into its trend $(T_t)$ and cyclical $(C_t)$ components:

$$

GDP_t = T_t + C_t

$$ - The $HP filter$ minimizes the following loss function:

$$

\sum_t (GDP_t - T_t)^2 + \lambda \sum_t \left[(T_{t+1} - T_t) - (T_t - T_{t-1})\right]^2

$$

where $(\lambda)$ is a smoothing parameter (typically $1600$ for quarterly data).

- Decompose GDP into its trend $(T_t)$ and cyclical $(C_t)$ components:

Visualize:

Plot the original GDP, trend, and cyclical components to analyze economic fluctuations.

Python Code

1 | import numpy as np |

Explanation of the Code

Simulated GDP Data:

- Real GDP is modeled as a combination of a long-term trend, a cyclical fluctuation, and random noise.

Hodrick-Prescott Filter:

- The $HP filter$ separates the GDP into a smooth trend and short-term deviations (cyclical component).

- The smoothing parameter $(\lambda)$ controls the smoothness of the trend; $1600$ is standard for quarterly data.

Visualization:

- The first plot shows the original GDP and its trend.

- The second plot highlights the cyclical component, indicating deviations from the long-term trend.

Results

Original GDP Mean: 161.77 Trend Component Mean: 0.00 Cyclical Component Mean: 161.77 (should be ~0)

Trend Component:

- Represents the long-term economic growth path.

Cyclical Component:

- Indicates business cycle fluctuations around the trend.

- Peaks and troughs correspond to economic expansions and contractions, respectively.

Insights:

- The cyclical component helps identify recessions and booms.

- Policymakers and economists use this analysis to design countercyclical measures.