I’ll create a marketing analytics example using Python to analyze customer segmentation based on purchase behavior and create visualizations.

We’ll use the RFM (Recency, Frequency, Monetary) analysis, which is a common marketing technique.

1 | import pandas as pd |

Let me explain the code and analysis:

Data Generation:

- Created sample data for 1000 customers

- Generated random purchase dates within the last year

- Simulated purchase frequencies using Poisson distribution

- Generated monetary values using normal distribution

RFM Analysis:

- Recency: Days since last purchase

- Frequency: Number of purchases

- Monetary: Total amount spent

- Scored each component from 1-4 based on quartiles

- Combined scores to create RFM_score

Customer Segmentation:

- Best Customers: Highest RFM scores

- Loyal Customers: Good RFM scores

- Average Customers: Medium RFM scores

- Lost Customers: Low RFM scores

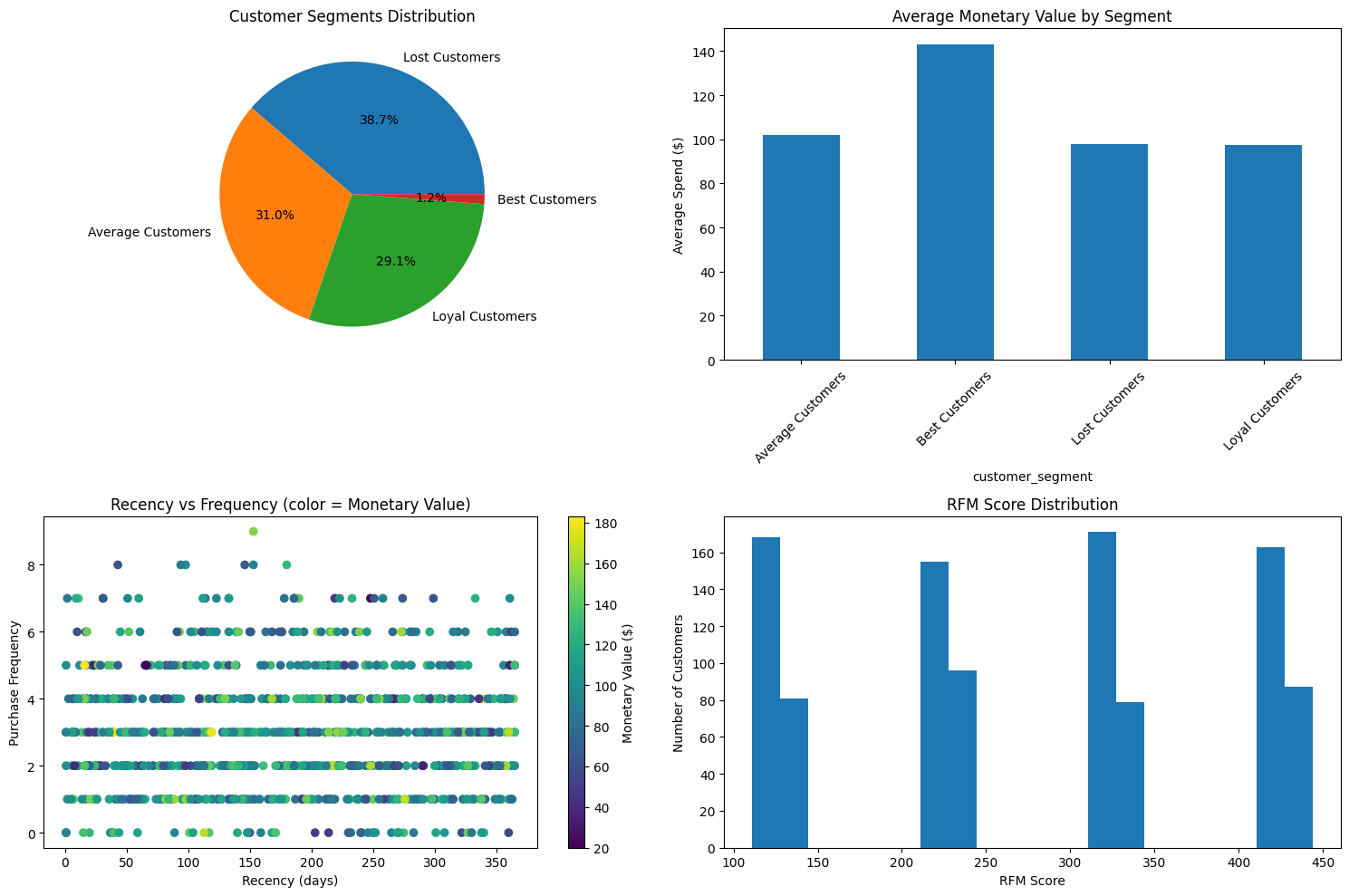

Visualizations:

- Pie chart showing distribution of customer segments

- Bar chart showing average spend by segment

- Scatter plot of recency vs frequency

- Histogram of RFM scores

Output

Customer Segment Summary:

customer_id total_monetary_value purchase_frequency \

customer_segment

Average Customers 310 101.87 3.07

Best Customers 12 143.16 5.58

Lost Customers 387 97.72 2.52

Loyal Customers 291 97.65 3.38

recency

customer_segment

Average Customers 172.13

Best Customers 40.75

Lost Customers 286.34

Loyal Customers 64.54

The analysis provides several key insights:

- Customer segment distribution shows the proportion of customers in each category

- Average monetary value by segment helps identify high-value customer groups

- Recency vs Frequency plot reveals customer purchase patterns

- RFM Score distribution shows the overall spread of customer values