We will simulate the effects of monetary policy on an economy using a simplified model.

The main variables are:

- Interest Rate (r):

Set by the central bank. - Inflation Rate (π):

Determined by economic conditions and influenced by monetary policy. - Output Gap (Y):

The difference between actual output and potential output, affected by interest rate changes.

This simulation will follow the logic of the Taylor Rule, a common monetary policy guideline:

$$

r = r^* + \phi_\pi (\pi - \pi^*) + \phi_Y Y

$$

- $(r^*)$ is the neutral interest rate.

- $(\pi^*)$ is the target inflation rate.

- $(\phi_\pi) and (\phi_Y)$ are policy reaction coefficients for inflation and output gap.

Python Implementation

Below is the $Python$ code to simulate the impact of monetary policy adjustments on inflation and the output gap over time.

1 | import numpy as np |

Explanation of the Code

- Model Setup:

- The neutral interest rate $(r^*)$, target inflation rate $(\pi^*)$, and policy reaction coefficients $(\phi_\pi$, $\phi_Y)$ are defined.

- Simulation Loop:

- The interest rate is updated using the Taylor Rule.

- The output gap and inflation rate are updated based on the interest rate, reflecting the dynamics of monetary policy.

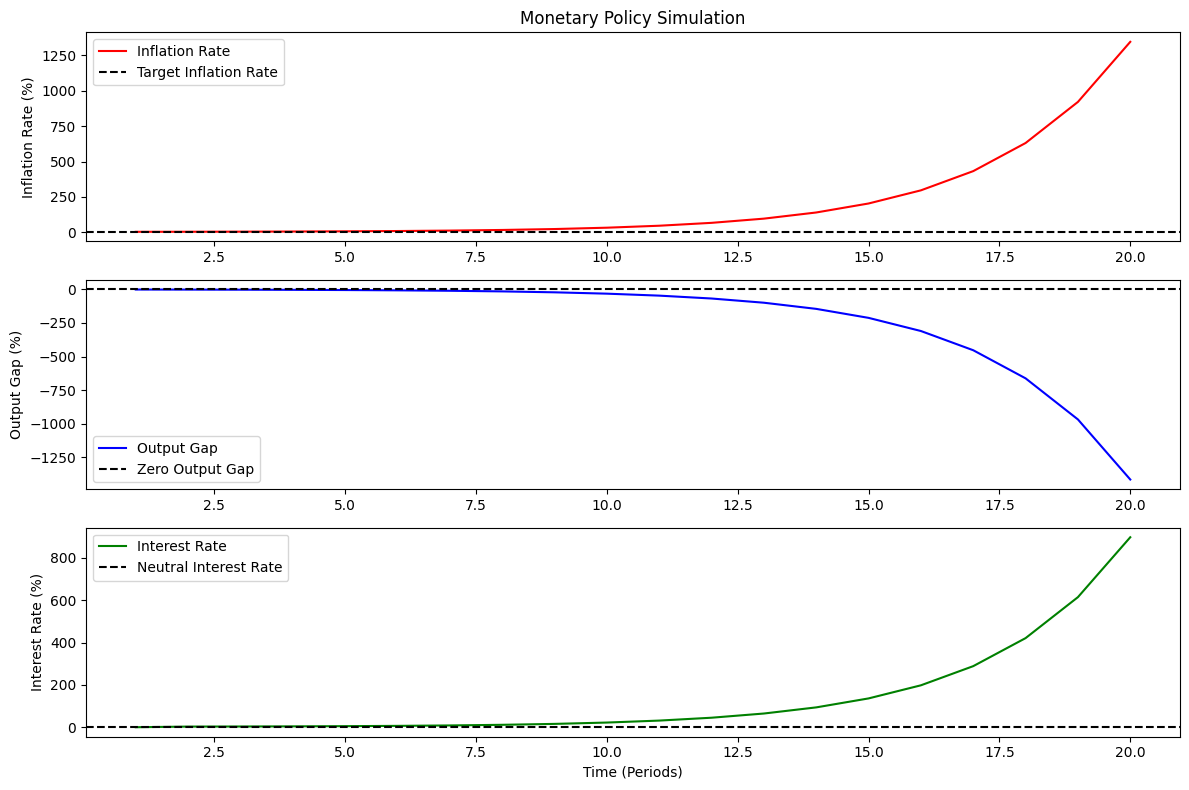

- Visualization:

- The results for inflation, output gap, and interest rate over time are plotted.

Expected Results

- Inflation Rate:

Gradually converges toward the target rate $(\pi^* = 2%)$. - Output Gap:

Oscillates and eventually stabilizes around zero. - Interest Rate:

Adjusts dynamically based on the Taylor Rule to stabilize inflation and output.

The graphs will visually illustrate these dynamics, helping to understand how monetary policy impacts an economy over time.