1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

29

30

31

32

33

34

35

36

37

38

39

40

41

42

43

44

45

46

47

48

49

50

51

52

53

54

55

56

57

58

59

60

61

62

63

64

65

66

67

68

69

70

71

72

73

74

75

76

77

78

79

80

81

82

83

84

85

86

87

88

89

90

91

92

93

94

95

96

97

98

99

100

101

102

| import os, gym

import datetime

import gym_anytrading

import matplotlib.pyplot as plt

from gym_anytrading.envs import TradingEnv, ForexEnv, StocksEnv, Actions, Positions

from gym_anytrading.datasets import FOREX_EURUSD_1H_ASK, STOCKS_GOOGL

from stable_baselines.common.vec_env import DummyVecEnv

from stable_baselines import PPO2

from stable_baselines import ACKTR

from stable_baselines.bench import Monitor

from stable_baselines.common import set_global_seeds

import numpy as np

import matplotlib.pyplot as plt

def simulation(i, window_size):

global means

# ログフォルダの生成

log_dir = './logs/'

os.makedirs(log_dir, exist_ok=True)

# [20] 2020-06-28 10:00

idx1 = 50

#

idx2 = 350

# データ数

span = idx2 - idx1

# 環境の生成

env = gym.make('forex-v0', frame_bound=(idx1, idx2), window_size=window_size)

env = Monitor(env, log_dir, allow_early_resets=True)

# シードの指定

env.seed(0)

set_global_seeds(0)

# ベクトル化環境の生成

env = DummyVecEnv([lambda: env])

# モデルの生成

#model = PPO2('MlpPolicy', env, verbose=1)

model = ACKTR('MlpPolicy', env, verbose=1)

# モデルの読み込み

#model = PPO2.load('trading_model{}'.format(i))

model = ACKTR.load('trading_model{}'.format(i))

# モデルの学習

#model.learn(total_timesteps=128000)

# モデルの保存

#model.save('trading_model{}'.format(i))

# モデルのテスト

#env = gym.make('forex-v0', frame_bound=(idx2+500, idx2 + span+500), window_size=20)

env = gym.make('forex-v0', frame_bound=(idx1+400, idx2+400), window_size=window_size)

env.seed(0)

state = env.reset()

while True:

# 行動の取得

action, _ = model.predict(state)

# 1ステップ実行

state, reward, done, info = env.step(action)

# エピソード完了

if done:

print('info:', info, info['total_reward'])

means.append(info['total_reward'])

break

# グラフのプロット

plt.cla()

env.render_all()

#plt.savefig('trading{:%Y%m%d_%H%M%S}.png'.format(datetime.datetime.now()))

#plt.show()

#with open('C:/Util/anaconda3/envs/openai_gym/lib/site-packages/gym_anytrading/datasets/data/FOREX_EURUSD_1H_ASK.csv', 'r') as f:

# lines = f.readlines()

# s1 = lines[idx1].split(',')[0]

# s2 = lines[idx2-1].split(',')[0]

# #print(s1,s2, (idx2 - idx1))

#

# s3 = lines[idx2].split(',')[0]

# s4 = lines[idx2+span].split(',')[0]

# #print(s3,s4, (idx2+span - idx2))

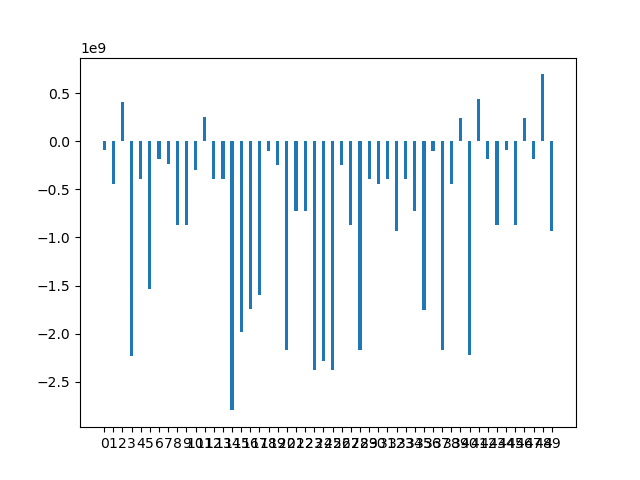

labels = []

means = []

for i in range(50):

labels.append('{}'.format(i))

simulation(1, 50)

x = np.arange(len(labels))

width = 0.35

fig, ax = plt.subplots()

rect = ax.bar(x, means, width)

ax.set_xticks(x)

ax.set_xticklabels(labels)

#plt.show()

plt.savefig('trading{:%Y%m%d_%H%M%S}.png'.format(datetime.datetime.now()))

|